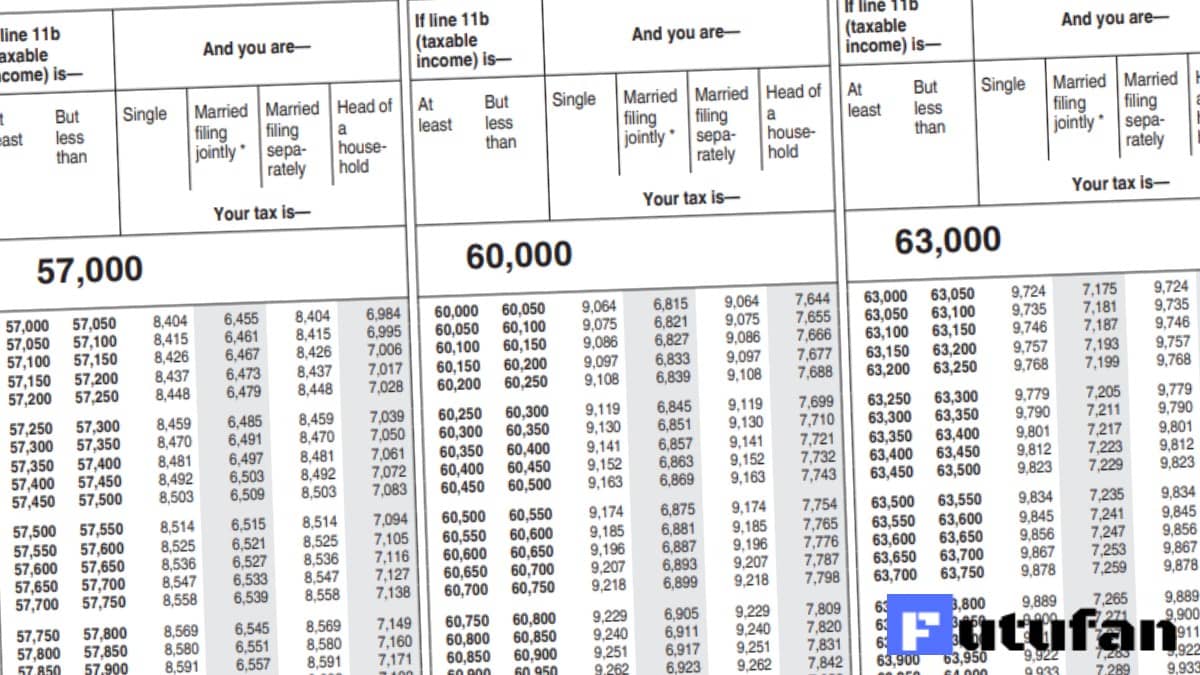

My overview of the Earned Income Tax Credit may be of interest as well. Married Filing Jointly (& Surviving Spouses)įor more information on standard deductions, itemizing taxes, various tax credits and deductions, and much more, check out the IRS website and my summarized “ how to do your taxes” guide. With that in mind, here are the 2021 tax brackets: In other words, it is taxed in steps, or brackets. The United States federal income tax system is a “progressive” tax system, which means that your effective (actual) tax rate is less than the tax rate in the top bracket you are in. Many taxpayers incorrectly assume that if your total income peaks in the 35% tax bracket, for example, then all of your income is taxed at that rate. As an example, if you are single (unmarried) and your taxable income is $50,000, your tax tax rate on your first $9,875 of taxable income is 10%, taxable income between $9,950 and $40,525 is taxed at 12%, and taxable income between $40,525 to $50,000 (your income) would be taxed at 22%. In the tables below, it is important to note that the highlighted rates represent the income tax rate owed for the portion of your taxable income that falls into that bracket. 2021 Tax Brackets (IRS Federal Income Tax Rates Table) Barring new legislative changes, these brackets will continue through 2025. With the Tax Cut & Jobs Act (tax reform implemented in 2018), the 20 tax brackets, tax rates, and standard deduction amounts have all been heavily revised from pre-reform levels. This will help prevent being penalized for underpayment of taxes or getting a refund (which is really a form of self-penalization by letting the government borrow your money, interest-free). Armed with the below information, it would be an excellent time to calculate what your modified adjusted gross income will likely be next year and modify your tax withholding on your W4 form. Since we’re still focused on 2021 for tax filing purposes, the 2021 tax brackets are going to be of most interest to you when you do your upcoming taxes, so I have included those as well.

0 kommentar(er)

0 kommentar(er)